When you're shopping for a home loan, the choice between 30 year mortgage rates and 15-year options can feel overwhelming. Both have their place in the mortgage landscape, but the right choice depends entirely on your financial situation and long-term goals. 30 year mortgage rates typically offer lower monthly payments but higher total interest costs, while 15-year mortgages demand higher monthly payments in exchange for significant interest savings.

Understanding the key differences between these mortgage terms isn't just about comparing numbers on paper. It's about aligning your home financing with your broader financial strategy, whether you're a first-time buyer managing buy now pay later debt or an experienced homeowner looking to refinance. Let's break down exactly what each option offers and help you make an informed decision.

Understanding Your Mortgage Term Options

The mortgage term you choose fundamentally shapes your homeownership experience. A mortgage term refers to the length of time you have to repay your home loan, and it directly impacts both your monthly payment and the total amount you'll pay over the life of the loan.

The 30-Year Mortgage Landscape

30 year mortgage rates have dominated the American housing market for decades. This loan structure spreads your payments across three decades, creating smaller monthly obligations that fit more comfortably into most household budgets. Current mortgage rates for 30-year loans typically run higher than shorter-term options, but the extended payment period keeps monthly costs manageable.

Why It Matters: The 30-year mortgage isn't just about affordability—it's about financial flexibility. Lower monthly payments free up cash flow for other investments, emergency savings, or managing existing debt like buy now pay later obligations.

The 15-Year Alternative

Fifteen-year mortgages offer a completely different approach to home financing. While home loan mortgage rates for 15-year terms are typically 0.25% to 0.75% lower than 30-year rates, the shorter payment period creates substantially higher monthly payments. However, this trade-off delivers massive interest savings over the loan's lifetime.

The appeal of 15-year mortgages has grown among borrowers who prioritize debt elimination and wealth building. These loans particularly attract established professionals, empty nesters, and anyone looking to own their home outright in half the time.

Key Considerations for Each Option

Your choice between these mortgage terms should align with your current financial capacity and future goals. Consider your monthly budget constraints, career stability, other debt obligations, and long-term financial objectives. Banking consumers often find that their ideal mortgage term depends on factors like job security, family size, and retirement timeline.

Detailed Comparison of Mortgage Terms

Understanding the practical differences between 30-year and 15-year mortgages requires examining real numbers and scenarios. Let's break down how these options compare across the most important factors.

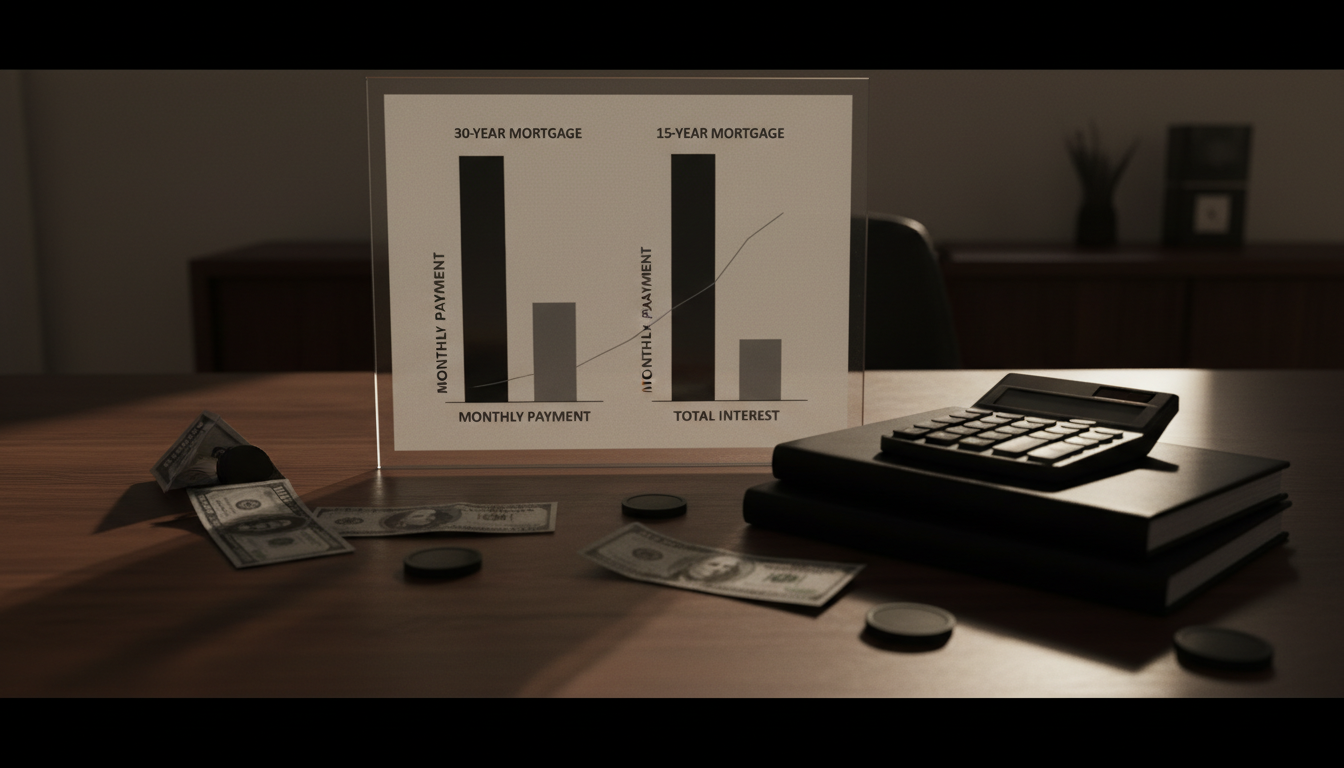

Monthly Payment Comparison

The most immediate difference you'll notice is in monthly payments. For a $300,000 mortgage, here's how the numbers typically break down:

| Loan Term | Interest Rate | Monthly Payment | Total Interest |

|---|---|---|---|

| 30 Years | 7.5% | $2,098 | $455,280 |

| 15 Years | 7.0% | $2,696 | $185,280 |

The 15-year mortgage demands about $600 more per month, but saves over $270,000 in total interest. This represents the core trade-off: immediate cash flow versus long-term wealth preservation.

Interest Rate Advantages

Latest mortgage rates consistently show that 15-year mortgages offer lower interest rates than their 30-year counterparts. This rate advantage exists because lenders face less risk with shorter-term loans. The borrower pays off the principal faster, reducing the lender's exposure to interest rate fluctuations and default risk over time.

Expert Tip: Even a 0.5% rate difference compounds significantly over time. On a $300,000 loan, that half-percentage point can save tens of thousands in interest payments.

Total Cost Analysis

The total cost difference between these mortgage terms is staggering. While 30 year mortgage rates result in lower monthly payments, the extended payment period means you'll pay interest for an additional 15 years. This extended interest period typically doubles or triples your total interest costs compared to a 15-year mortgage.

Cash Flow Impact

Monthly cash flow considerations extend beyond just mortgage payments. The extra $600 per month required for a 15-year mortgage could alternatively fund retirement accounts, emergency savings, or pay down high-interest debt like credit cards or buy now pay later balances. Credit union customers often weigh this opportunity cost carefully when choosing their mortgage term.

Pros and Cons of Each Option

30-Year Mortgage Advantages

The extended payment period of 30 year mortgage rates creates several compelling benefits:

Lower Monthly Payments: The most obvious advantage is affordability. Spreading payments across 30 years significantly reduces your monthly housing costs, making homeownership accessible to more buyers.

Increased Buying Power: Lower monthly payments mean you can qualify for a larger loan amount, potentially allowing you to purchase a more expensive home or one in a better neighborhood.

Financial Flexibility: The difference between 30-year and 15-year payments can fund other financial goals. You might invest the extra money, build an emergency fund, or pay down other debts more aggressively.

Tax Benefits: Mortgage interest deductions remain available for the full 30-year term, providing ongoing tax advantages for eligible borrowers.

Key Takeaway: The 30-year mortgage prioritizes financial flexibility and accessibility over long-term cost efficiency. It's designed for borrowers who value lower monthly obligations and want to preserve cash flow for other purposes.

30-Year Mortgage Disadvantages

However, the extended term comes with significant drawbacks:

Higher Total Interest: You'll pay substantially more interest over the loan's lifetime—often two to three times more than a 15-year mortgage.

Slower Equity Building: With lower principal payments in the early years, you build home equity more slowly, limiting your ability to tap into that equity for future needs.

Higher Interest Rates: Mortgage loan rates today show that 30-year loans typically carry higher rates than shorter terms, compounding the total cost difference.

15-Year Mortgage Advantages

The shorter term delivers powerful financial benefits:

Massive Interest Savings: The primary advantage is the dramatic reduction in total interest paid. You'll typically save hundreds of thousands of dollars compared to a 30-year mortgage.

Faster Equity Building: Higher principal payments mean you build equity quickly, creating a valuable financial asset sooner.

Lower Interest Rates: Current mortgage rates for 15-year loans are typically 0.25% to 0.75% lower than 30-year rates.

Debt Freedom: You'll own your home outright in half the time, eliminating your largest monthly expense 15 years earlier.

15-Year Mortgage Disadvantages

The shorter term also creates challenges:

Higher Monthly Payments: The most significant barrier is affordability. Monthly payments are typically 40% to 60% higher than comparable 30-year loans.

Reduced Flexibility: Higher mortgage payments leave less room in your budget for other financial goals or unexpected expenses.

Stricter Qualification Requirements: The higher payment requirements mean you'll need higher income and better debt-to-income ratios to qualify.

When to Choose Each Option

Choose a 30-Year Mortgage When:

Several scenarios make 30 year mortgage rates the optimal choice:

You're a First-Time Buyer: New homeowners often benefit from lower monthly payments while they adjust to homeownership costs and build financial stability. The extra cash flow helps manage unexpected repairs, property taxes, and insurance costs.

You Have Other High-Interest Debt: If you're carrying credit card balances or buy now pay later debt with rates above 10%, the extra monthly savings from a 30-year mortgage can help eliminate these costlier obligations first.

You're Building an Emergency Fund: Financial experts recommend 3-6 months of expenses in emergency savings. If you haven't reached this goal, the lower payments of a 30-year mortgage can help you build this crucial safety net.

You Plan to Invest the Difference: Disciplined investors who can consistently invest the monthly payment difference in diversified portfolios may come out ahead over time, especially in tax-advantaged accounts.

Pro Tip: The key to making a 30-year mortgage work in your favor is actually using the extra monthly cash flow productively. Simply spending the difference on lifestyle inflation negates the strategic benefits.

Choose a 15-Year Mortgage When:

Certain financial situations strongly favor the shorter term:

You Have Stable, High Income: If your income is secure and substantially exceeds your basic living expenses, the higher payments become manageable while delivering massive long-term savings.

You're Approaching Retirement: Borrowers in their 40s or early 50s often prefer 15-year mortgages to eliminate housing costs before retirement, when income typically decreases.

You prioritize debt elimination: If becoming debt-free is a primary financial goal, the 15-year mortgage aligns perfectly with this objective.

You have minimal other debt: When you've already eliminated high-interest debt and built adequate emergency savings, the 15-year mortgage becomes an attractive wealth-building tool.

Making Your Decision

Financial Readiness Assessment

Before choosing your mortgage term, honestly evaluate your financial situation. Calculate your debt-to-income ratio including the potential mortgage payment, assess your emergency fund adequacy, and consider your job security and income stability.

Banking consumers should also factor in other financial goals. Are you saving adequately for retirement? Do you have children who will need college funding? These competing priorities might influence whether you can handle higher 15-year mortgage payments.

The Hybrid Approach

Some borrowers choose a middle ground by taking a 30-year mortgage but making extra principal payments when possible. This strategy provides payment flexibility during tight months while still reducing total interest costs. You can always pay extra toward principal, but you can't reduce a required 15-year payment when money gets tight.

Key Insight: The hybrid approach works best for borrowers with variable income or those who want the security of lower required payments but the discipline to pay extra when possible.

Interest Rate Environment Considerations

Today's mortgage rates environment also influences this decision. When rates are historically low, the opportunity cost of a 30-year mortgage decreases because you're locking in cheap money for three decades. Conversely, when rates are high, the interest savings from a 15-year mortgage become even more compelling.

Common Questions About Mortgage Terms

How Much Can I Save with a 15-Year Mortgage?

The savings depend on your loan amount and interest rates, but they're typically substantial. On a $400,000 mortgage, you might save $300,000 to $400,000 in total interest by choosing a 15-year term over 30 years. However, this comes with monthly payments that are $700 to $900 higher, so you need adequate cash flow to handle the increased obligation.

Can I Refinance to Change My Mortgage Term Later?

Yes, refinancing allows you to change your mortgage term, but it involves costs and qualification requirements. You'll pay closing costs typically ranging from 2% to 5% of your loan amount, and you'll need to qualify based on current income, credit, and home value. Market conditions and your financial situation at the time will determine whether refinancing makes sense.

What If I Want to Pay Off My 30-Year Mortgage Early?

Most 30-year mortgages allow extra principal payments without penalties. You can make additional payments toward principal whenever you have extra money, effectively creating your own flexible payment schedule. This approach provides the security of lower required payments while still allowing you to reduce total interest costs when your budget allows.

How Do Mortgage Terms Affect My Home Buying Budget?

Your mortgage term directly impacts how much home you can afford. With a 30-year mortgage, you might qualify for a loan that's 40% to 60% larger than what you'd qualify for with a 15-year term. This difference can mean the distinction between affording a starter home versus your ideal home, or buying in a preferred neighborhood versus settling for a less desirable area.

Final Thoughts

Choosing between 30 year mortgage rates and 15-year options isn't just about numbers—it's about aligning your home financing with your broader financial strategy and life goals. The 30-year mortgage offers flexibility and accessibility, making homeownership possible for more people while preserving cash flow for other priorities. The 15-year mortgage demands higher monthly commitments but delivers substantial long-term savings and faster wealth building. Consider your current financial capacity, future goals, and risk tolerance when making this important decision. Get started with CreditMaxxer to explore your mortgage options and find the term that works best for your situation. Ready to get started? Visit CreditMaxxer to learn more.