Understanding 30 year loan rates is essential for anyone considering a major purchase like a home. These rates represent the interest you'll pay on a loan that spans three decades, making them one of the most significant financial decisions you'll ever make. Whether you're a first-time homebuyer exploring mortgage options or someone managing buy now pay later debt who's considering consolidation through a home equity loan, getting familiar with how these rates work can save you thousands of dollars over time.

The world of 30 year loan rates might seem complex, but it's really about understanding a few key concepts. These rates fluctuate based on economic conditions, your creditworthiness, and the type of loan you choose. In this guide, we'll break down everything you need to know about 30 year loan rates, from how they're determined to strategies for securing the best possible terms.

What Are 30 Year Loan Rates?

A 30 year loan rate is the annual interest percentage charged on a loan with a 30-year repayment term. Most commonly associated with mortgages, these rates determine how much you'll pay in interest over the life of your loan. The "30 year" refers to the amortization period—the time it takes to fully repay the loan through regular monthly payments.

The Anatomy of 30 Year Loan Rates

When lenders quote 30 year loan rates, they're typically referring to the Annual Percentage Rate (APR) or the interest rate. The interest rate is the basic cost of borrowing money, while the APR includes additional costs like origination fees, discount points, and other loan-related expenses. Understanding this distinction is crucial because the APR gives you a more complete picture of the loan's true cost.

Key Insight: The difference between interest rate and APR can be significant. A loan with a 6.5% interest rate might have a 6.8% APR once fees are factored in.

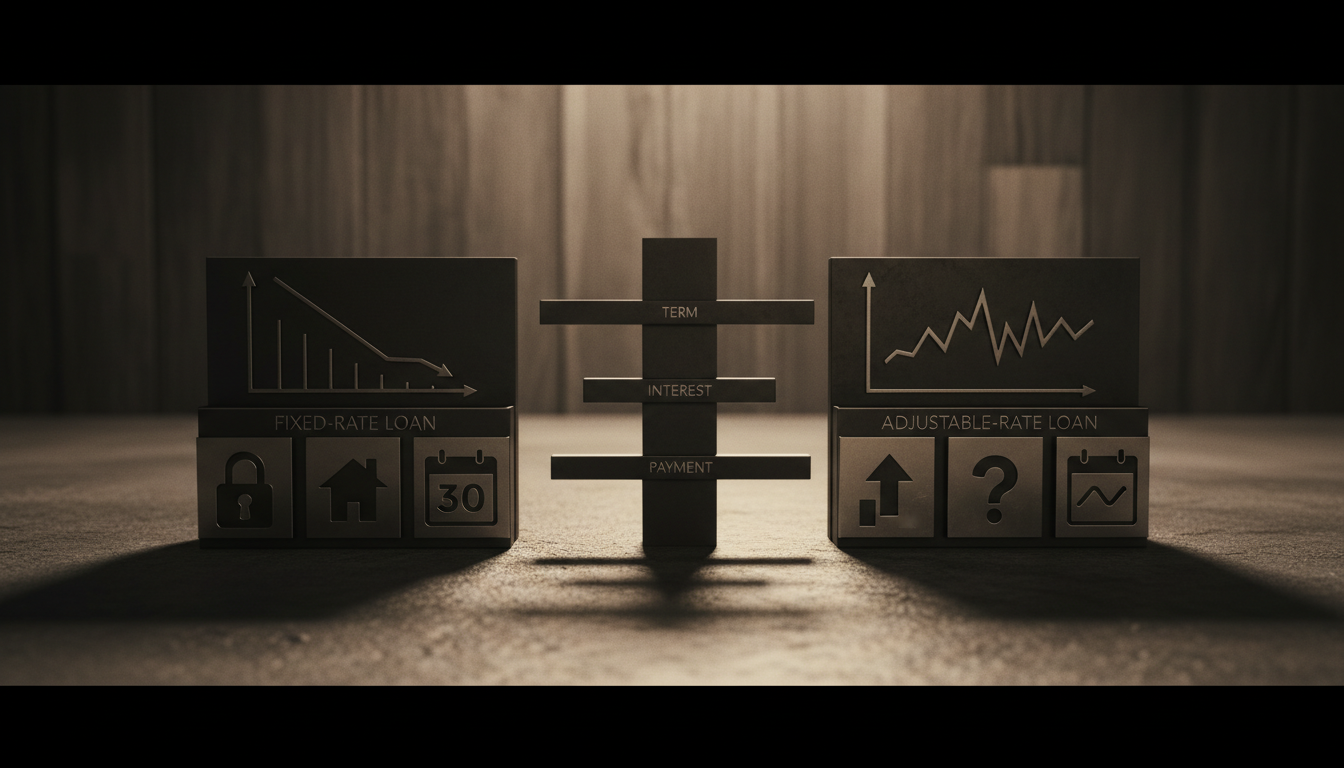

Fixed vs. Variable 30 Year Loan Rates

Most 30 year loans offer fixed rates, meaning your interest rate stays the same throughout the entire loan term. This predictability makes budgeting easier and protects you from rising interest rates. However, some lenders offer adjustable-rate mortgages (ARMs) that start with lower rates for an initial period before adjusting based on market conditions.

Fixed-rate 30 year loans provide stability but typically start with higher rates than ARMs. Variable rates can offer initial savings but carry the risk of significant payment increases if rates rise substantially.

Current Market Context

Today's mortgage rates today reflect broader economic conditions, including Federal Reserve policy, inflation expectations, and bond market performance. Home loan mortgage rates have experienced significant volatility in recent years, making it more important than ever to understand how these rates work and when to lock in favorable terms.

How 30 Year Loan Rates Are Determined

The process of setting 30 year loan rates involves multiple factors that lenders carefully evaluate. Understanding these factors helps you better position yourself for favorable rates and realistic expectations about what you might qualify for.

Economic Factors

Mortgage rates closely follow the 10-year Treasury bond yield, which reflects investor confidence in the economy. When economic uncertainty rises, investors flock to safe government bonds, driving yields down and often bringing mortgage rates with them. Conversely, strong economic growth typically pushes rates higher as investors seek better returns in riskier assets.

The Federal Reserve's monetary policy plays a crucial role in current mortgage rates. While the Fed doesn't directly set mortgage rates, its decisions about short-term interest rates influence the entire yield curve, affecting everything from credit card rates to 30 year loan rates.

Why It Matters: Economic conditions beyond your control significantly impact the rates available to you. Timing your loan application during favorable economic periods can save thousands over the loan's life.

Personal Credit Factors

Your credit score is perhaps the most important factor in determining your specific rate. Lenders use credit scores to assess default risk, with higher scores earning better rates. A borrower with a 760+ credit score might receive rates 0.5% to 1% lower than someone with a 620 credit score.

Debt-to-income ratio (DTI) is another critical factor. Lenders prefer borrowers whose total monthly debt payments, including the new loan, don't exceed 36-43% of their gross monthly income. Lower DTI ratios often qualify for better rates because they indicate stronger ability to repay the loan.

Loan-Specific Factors

The loan-to-value ratio (LTV) significantly impacts your rate. Borrowers who put down 20% or more typically receive better rates than those with smaller down payments. This is because higher down payments reduce the lender's risk and eliminate the need for private mortgage insurance (PMI).

Loan amount also matters. Conforming loans that fall within government-sponsored enterprise limits often receive better rates than jumbo loans that exceed these limits. The latest mortgage rates frequently show a spread between conforming and jumbo loan rates.

Types of 30 Year Loan Products

Different types of 30 year loans serve various borrower needs and circumstances. Understanding your options helps you choose the product that best fits your financial situation and goals.

Conventional 30 Year Mortgages

Conventional mortgages are the most common type of 30 year loan. These loans aren't backed by government agencies and typically require higher credit scores and down payments than government-backed alternatives. However, they often offer competitive rates and more flexible terms.

Conventional loans come in two varieties: conforming and non-conforming (jumbo). Conforming loans meet the standards set by Fannie Mae and Freddie Mac, while jumbo loans exceed the conforming loan limits set for your area.

Government-Backed 30 Year Loans

FHA loans offer 30 year terms with lower down payment requirements and more flexible credit standards. While they require mortgage insurance, they can be excellent options for first-time buyers or those with less-than-perfect credit.

VA loans provide 30 year financing for eligible veterans and service members, often with no down payment required and competitive rates. USDA loans offer similar benefits for qualified rural and suburban homebuyers.

Pro Tip: Government-backed loans often have slightly higher rates than conventional loans, but the lower down payment requirements can make homeownership more accessible.

Specialty 30 Year Loan Products

Some lenders offer specialty products like interest-only 30 year loans, where you pay only interest for an initial period before principal and interest payments begin. These products can be risky but might make sense for borrowers with irregular income or specific financial strategies.

Bank statement loans and other non-QM (non-qualified mortgage) products provide 30 year terms for self-employed borrowers or those with complex financial situations who might not qualify for traditional financing.

Comparison of 30 Year Loan Types

| Loan Type | Minimum Credit Score | Down Payment | Key Benefits |

|---|---|---|---|

| Conventional | 620+ | 3-5% | Flexible terms, no upfront insurance |

| FHA | 580+ | 3.5% | Lower credit requirements, smaller down payment |

| VA | No minimum | 0% | No down payment, no PMI for veterans |

| USDA | 640+ | 0% | Rural/suburban focus, no down payment |

Each loan type serves different borrower needs, and the best choice depends on your specific circumstances, credit profile, and homebuying goals.

Strategies for Getting Better 30 Year Loan Rates

Securing favorable 30 year loan rates requires preparation and strategic thinking. The difference between a good rate and a great rate can save you tens of thousands of dollars over the loan's lifetime.

Improving Your Credit Profile

Start by checking your credit report for errors and disputing any inaccuracies you find. Even small improvements in your credit score can lead to better rates. Pay down existing debt to improve your credit utilization ratio, and avoid opening new credit accounts in the months before applying for your loan.

For buy now pay later borrowers, consolidating multiple small debts into a single payment can improve your credit profile and make it easier to qualify for better mortgage rates. CreditMaxxer specializes in helping borrowers manage and consolidate various debt obligations to improve their overall financial picture.

Expert Tip: Timing matters when improving credit. Most positive changes take 30-60 days to appear on your credit report, so start the improvement process well before you plan to apply for your loan.

Shopping for Rates

Different lenders offer different rates, even to the same borrower on the same day. Rate shopping within a 14-45 day window typically counts as a single credit inquiry, minimizing the impact on your credit score. Get quotes from at least three different lenders, including banks, credit unions, and online lenders.

Don't just compare rates—compare the total cost of the loan, including fees, closing costs, and any discount points. A slightly higher rate with lower fees might save you money overall, especially if you don't plan to keep the loan for the full 30 years.

Timing Your Application

Mortgage loan rates today can change daily or even multiple times per day. If you see favorable rates, consider locking in your rate with your lender. Most lenders offer rate locks for 30-60 days while your loan processes, protecting you from rate increases during that period.

Monitor economic indicators and Federal Reserve announcements that might signal rate changes. While you can't time the market perfectly, understanding trends can help you make more informed decisions about when to apply and when to lock your rate.

Common Misconceptions About 30 Year Loan Rates

Several myths about 30 year loan rates persist, and believing them can cost you money or prevent you from making informed decisions about your financing.

"You Should Always Take the Lowest Rate"

While a lower rate generally saves money, it's not always the best choice. Some low-rate loans come with high fees, discount points, or restrictive terms that might not align with your plans. Calculate the total cost of each loan option, considering how long you plan to keep the loan.

If you plan to sell or refinance within a few years, paying points to buy down your rate might not make financial sense. Conversely, if you plan to keep the loan for many years, paying points upfront could save significant money over time.

"30 Year Loans Are Always More Expensive Than Shorter Terms"

While 30 year loans do result in more total interest paid over the loan's life, they're not necessarily more expensive for every borrower's situation. The lower monthly payments of a 30 year loan provide flexibility that can be valuable for cash flow management or investment opportunities.

Key Takeaway: The "best" loan term depends on your financial goals, cash flow needs, and investment opportunities. Don't automatically assume shorter is always better.

"Rates Are the Same Everywhere"

Different lenders can offer significantly different rates to the same borrower. Credit unions often provide competitive rates to members, while online lenders might offer streamlined processes and competitive pricing. Local banks might provide personalized service and flexible underwriting.

Even within the same institution, different loan officers or branches might offer slightly different terms. This variation makes shopping around essential for securing the best possible rate and terms.

Frequently Asked Questions

What's considered a good 30 year loan rate?

A good 30 year loan rate depends on current market conditions and your credit profile. Generally, rates within 0.25-0.5% of the national average for your credit score range are considered competitive. For borrowers with excellent credit (740+), rates within 0.125% of the best available rates represent good deals. Check Today's Mortgage Rates regularly to understand current market conditions and how your quoted rate compares.

How much can credit score impact my 30 year loan rate?

Credit score significantly impacts your rate, with differences of 1-2% between excellent and fair credit borrowers. A borrower with a 760 credit score might qualify for a 6.5% rate, while someone with a 620 score might receive 7.5% or higher. Over 30 years, this 1% difference on a $300,000 loan costs approximately $60,000 in additional interest.

Should I pay points to lower my 30 year loan rate?

Paying discount points makes sense if you plan to keep the loan long enough to recoup the upfront cost through monthly payment savings. Each point typically costs 1% of your loan amount and reduces your rate by 0.25%. Calculate your break-even point by dividing the point cost by your monthly payment savings. If you'll keep the loan longer than the break-even period, points can save money.

Can I refinance my 30 year loan if rates drop?

Yes, refinancing allows you to replace your current loan with a new one at potentially better terms. However, refinancing involves closing costs and fees, so the rate improvement should be significant enough to justify these expenses. A general rule suggests refinancing when you can reduce your rate by at least 0.5-0.75%, though this depends on your specific situation and how long you plan to keep the new loan.

What This Means for You

Understanding 30 year loan rates empowers you to make informed decisions about one of the largest financial commitments you'll ever make. Whether you're buying your first home or refinancing existing debt, securing favorable rates can save thousands over your loan's lifetime. Get started with CreditMaxxer to explore how proper debt management and credit optimization can help you qualify for the best possible rates.